Resources

Latest Articles

Latest Insights & Articles

(no article uploaded)

Tools and Guides

GST (Goods and Services Tax)

Goods and Services Tax (GST) is a 15% tax added to the price of most products and services in New Zealand. If your business is registered for GST, you must charge GST on what you sell and collect it on behalf of the government. At the same time, you can claim back the GST you pay on business-related purchases and expenses.

When to Register

You must register for GST if you expect to earn more than $60,000 in any 12-month period, whether you’re a sole trader, contractor, partnership, or company. Failing to register when required may result in penalties. If your turnover is below $60,000, registration is optional. Voluntary registration can sometimes benefit small businesses with high expenses, as you may be able to claim GST refunds.

GST Returns and Filing Periods

Once registered, you are required to file GST returns regularly. How often you file depends on your turnover:

Turnover | Filing Periods |

Below $500,000 | Monthly, two-monthly, or six-monthly filing options. |

$500,000 to $24 million | Monthly or two-monthly filing. |

Over $24 million | Monthly filing only |

Most small businesses choose two-monthly or six-monthly returns. Two-monthly filing provides more frequent tracking of cash flow, while six-monthly filing suits businesses with fewer invoices or expenses.

Accounting Methods

When you register, you must also choose how to account for GST:

- Payments basis – account for GST when payments are made or received.

- Invoice basis – account for GST when invoices are issued or received, even if unpaid.

- Hybrid basis – a combination of the two methods.

Many small businesses prefer the payments basis, as it avoids paying GST before receiving money from customers.

Record Keeping and Filing

It is important to keep accurate records of all invoices, receipts, and expenses for at least seven years. You should also set aside the GST you collect so it’s available when your return is due. GST returns can be filed online through Inland Revenue’s myIR service or sometimes directly via your accounting software, depending on the provider.

Zero-Rated Goods and Services

Certain goods and services are zero-rated, meaning GST is charged at 0%. This commonly applies to exports or specific land transactions. Even though GST is not charged, these supplies must still be included in your GST returns.

Deregistering for GST

If your annual turnover drops below $60,000 or you close your business, you may cancel your GST registration. Inland Revenue must be notified of the date you stop charging GST. At deregistration, GST may still be payable on any business assets you keep for personal or business use. If you fail to deregister, you will still be required to file returns.

Common Mistakes to Avoid

Some frequent GST errors include:

- Registering too early, before reaching the $60,000 threshold.

- Choosing the wrong accounting basis.

- Not keeping complete and accurate records for seven years.

- Forgetting to charge GST if you are registered.

- Failing to deregister when your business closes.

- Not including business assets in your final GST return after deregistration.

Disclaimer: The information provided is intended as a general guide only and does not constitute professional advice. For the most up-to-date and accurate information, please refer to the Inland Revenue Department (IRD) website or contact us to discuss your specific circumstances.

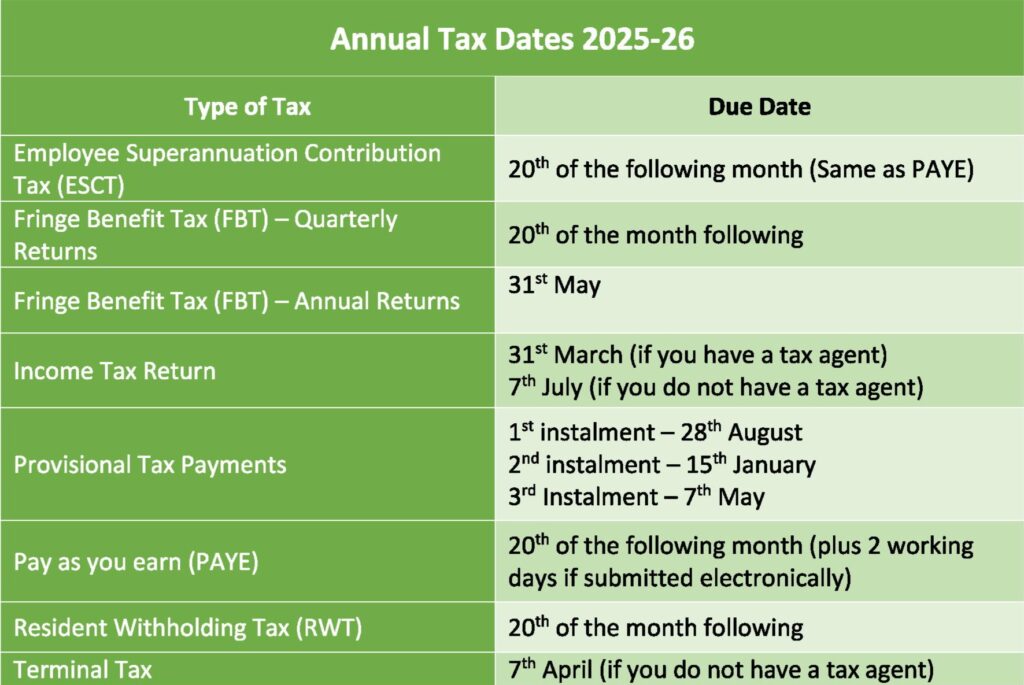

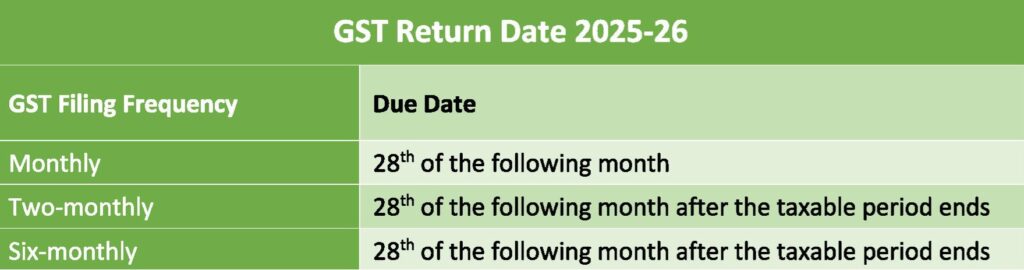

Key Tax Dates

Stay on Top of Important Tax Dates!

Tax deadlines can easily catch you off guard but keeping track of them helps you avoid penalties and maintain healthy cash flow. To make things simpler, we’ve created easy-to-follow tables outlining all the key tax dates for small business owners in New Zealand—from GST filing (monthly, bi-monthly, or annual) to provisional tax instalments, Fringe Benefit Tax (FBT), and Resident Withholding Tax (RWT) due dates. Check out the tax tables below to stay organised, and if you need support managing your tax, get in touch with us.

Case Studies

Our Success Stories

(No Case Studies uploaded)